In my previous post, I introduced you to two important strategies to use in paying down, or crushing, your debt: building savings and restructuring your loans. A third powerful strategy is to use the Cash Flow Index, and a fourth is to be cautious about locking money into assets.

After minimizing your payments and maximizing your cash flow, you’re now prepared to focus on one loan at a time until you’re completely debt-free.

Most financial advisers and pundits will tell you to pay off your loans with the highest interest rates first. My advice is to ignore the interest rate and use a technique developed by my 5 Day Weekend collaborator Garrett Gunderson and his team called the Cash Flow Index, which helps you determine which debt to pay off first.

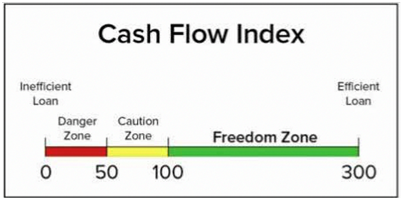

To determine your Cash Flow Index for each loan, divide the loan balance by the minimum payment. A low Cash Flow Index means the loan is inefficient. A loan with a high Cash Flow Index is efficient. As you can see on the chart below, any loan with a Cash Flow Index between 0 and 50 is in the danger zone and should be restructured or eliminated as quickly as possible. Any loan with a Cash Flow Index greater than 100 is in the freedom zone and is not a priority to pay off.

The loan to pay off first is the one with the lowest Cash Flow Index. For example, consider the following loans and ask yourself which one you would pay off first:

| Loan | Balance | Interest Rate | Monthly Payment |

Cash Flow Index |

| Mortgage | $228,000 | 7% | $1,665 | 137 ($228,000 ÷ $1,665) |

| Auto | $16,500 | 8% | $450 | 37 ($16,500 ÷ $450) |

| Credit Card | $13,000 | 12% | $260 | 50 ($13,000 ÷ $260) |

In the example in the table, it seems to make sense to pay off the credit card first because it has the highest interest rate. But the Cash Flow Index reveals that the auto loan should be paid off first. By doing so, you free up more monthly cash, which can then be applied toward the credit card balance. And then you can pay off both loans faster than if you started with the credit card.

The trick is to pay off the loan that gives you the greatest cash flow with the least investment.

4. BeCautious About Locking Money Into an Asset

Paying extra money to your mortgage can sometimes make sense when you’re financially stable, but other times it’s just locking money into hard-to-access equity. This strategy isn’t just about paying off debt faster and saving money on interest. It’s also about reducing your risk.

A good 5 Day Weekend rule here is to only put extra money into loans where your minimum payment goes down as your balance goes down as your balance goes down. Otherwise, you’re worsening yourcash flow Index with every payment. It doesn’t give you immediate benefit, and it increases your risk by reducing your liquidity.

A better move is to save the money that you would have paid on the loan balance in a separate account. Then let it accumulate and earn interest until you have enough to pay off the loan in full. (I’ll provide more details on this in a future blog.)

In my next post, I will look at why you got into debt in the first place – and a need for a fundamental shift in thinking surrounding debt.

In the meantime, I’d love to hear from you. Have you used the Cash Flow Index to see how your loans measure up? What did you find out? Thank you for sharing.

Secure your copy of the “5 Day Weekend” book. 5 Day Weekend: Freedom to Make Your Life and Work Rich with Purpose [Nik Halik & Garrett Gunderson]

Leave a Comment