Farmers know there is a season for everything. They plant in the spring, cultivate in the summer, harvest in the fall, and fields lay dormant in the winter.

Economists are also familiar with seasons and cycles. There is a natural, measurable, and predictable ebb and flow to economic activity. Most economic cycles are driven by human emotions, primarily fear, greed, and indecision. When you understand these cycles, you can invest with much greater confidence and clarity. You can calm your own emotions down and do the opposite of what most emotion-driven investors are doing.

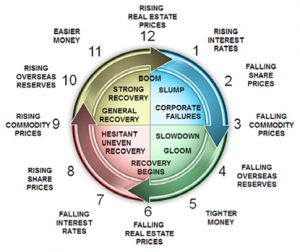

For more than three decades I’ve been using a methodology for gauging the economy, which has allowed me to predict economic seasons with great certainty. I compare economic cycles to the climatic seasons of summer, fall, winter, and spring, and I overlay these cycles onto an “economic clock” with times ranging from 1:00 to 12:00. I use this knowledge to determine the economic “temperature” and judge which investments are the best for each particular season.

Consider the diagram below:

Let’s start with 12:00, which is the height of the economic season of summer. The temperature is hot and simmering. It’s economic boom time and the overall consumer sentiment is buoyant. The economy is flush with cash, just as the season of summer is flush with more daylight. Inflation is running hot and it’s officially the market peak and top of the economic boom.

At 3:00 we have the fall, marking the transition from summer into winter, with temperatures cooling considerably. Just as leaves fall in autumn, in economic terms we experience falling share prices, commodity prices, and overseas reserves. Money becomes scarce as monetary policy is tightened.

At 6:00 the economy is in winter, the coldest climatic season. Animals hibernate during this season and there are no leaves on deciduous trees. In the economy there is a lack of confidence and investors hibernate by waiting on the sidelines, eagerly awaiting a recovery in the economy. Winter is the depth of the recession. It is in this barren period that property foreclosures and business bankruptcies are at their peak. When the dust settled from the financial collapse of 2008, $5 trillion in pension money, real estate value, 401(k)s, savings, and bonds had disappeared. Eight million Americans lost their jobs and six million lost their homes.

At 9:00 we enter spring. The weather is significantly warmer because the ground is tilted towards the sun. Plants grow and flowers bloom. Animals experience their breeding seasons. In economic spring, we have rising prices and an overall recovery in the global economy. Spring is the breeding season of consumer confidence and the easing of monetary policy. Spring is also the market absorption of property stock from the oversupply of economic winter, when many developers failed to sell their properties.

A full economic cycle, from 12:00 back to 12:00 (summer to summer), takes an average of eight to eleven years. A boom/bust cycle, from 12:00 at the top of the boom (summer) to 6:00 at the depth of the recession (winter), usually takes about three to four years. When it comes to human emotion, the fear of losing money is greater than the greed of making money. That’s why the markets reverse downwards like an elevator, creating widespread panic and selling.

In my next post, I’ll outline which economic indicators you should watch for that emerge at certain times on the economic clock, and what each of these times mean for you. In the meantime, I’d love to hear from you about your own ideas about economic cycles. Do these “seasons” make sense to you? Do you have another way of gauging the flow of the economy? Thank you for sharing.

Secure your copy of the “5 Day Weekend” book. 5 Day Weekend: Freedom to Make Your Life and Work Rich with Purpose [Nik Halik & Garrett Gunderson]

Leave a Comment